T&V Letter | Q3 2024

- Thalmann & Verling Trust reg.

- Oct 9, 2024

- 3 min read

Insight

Football fans love it when their team scores a goal from long range. Such goals are rare and exciting, but risky. The comparison with short-term investing is obvious: it feels good, but promises little chance of success.

Football llanalyst Ian Graham explains in his book "How to Win the Premier League" that only 4% of shots outside the penalty area result in goals, while 33% are scored inside the five-metre area. It is just as difficult to predict the market over short periods of time (e.g. 1 month or 1 year). Despite this, many try to bet on short-term trends - much like fans calling for the shot from distance.

Why do we still act like this? Three reasons:

False memories: Long-range goals and successful predictions remain more present than the many failures.

Quick rewards: Short-term gains are more exciting than long-term patience.

Peer pressure: Many market participants urge short-term decisions, just as fans urge long-distance shots.

Long shots in football and short-term speculation in investing rarely make sense. The shorter the investment horizon, the greater the uncertainty. While football thrives on risk, investments should be geared towards the long term.

Dear reader

Europe has long enjoyed high standards of living, characterised by a greater number of vacation days, low(er) crime rates, healthy diets and pedestrian-friendly cities - factors that in turn contribute to a higher life expectancy. The average life expectancy in the European Union is estimated at 81.5 years, compared to around 77.5 years in the USA. Although these hard-earned achievements are considerable, they could be jeopardised if no further measures are taken to increase productivity and prosperity. The wealth gap between the US and Europe has widened: GDP per capita in the US is around 30 % higher than in the eurozone.

Europe is increasingly becoming concerned about the growing economic and technological gap with the United States. Nicolai Tangen, head of the Norwegian sovereign wealth fund, said in an interview with the Financial Times that Americans work harder, while Europeans are less ambitious and more risk-averse. Peter Wennink, former CEO of Dutch chip manufacturer ASML, also warned last year that Europe is falling behind and needs to overcome its complacency.

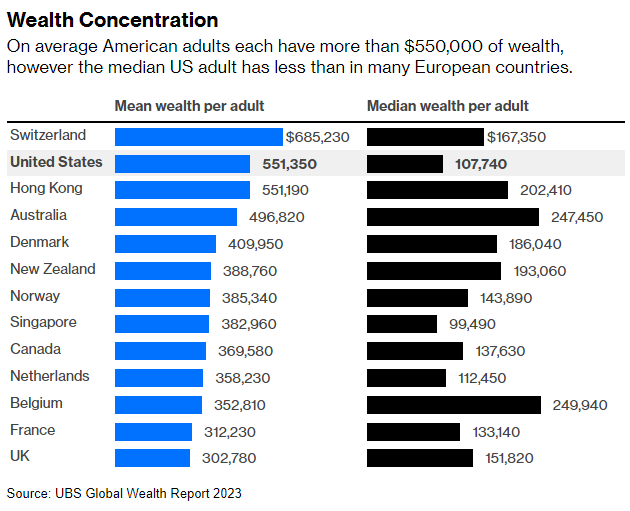

But keeping up with the US economically is difficult for Europe, as much of the transatlantic gap in GDP levels can be explained by faster population growth and Washington's fiscal generosity (which may not be sustainable). Nor should the higher average level of prosperity in the US obscure the fact that this prosperity is very unevenly distributed; the median level of prosperity in the US looks very different, as this chart shows:

Nevertheless, Americans are doing better financially. One of the main reasons for this is their approach to investing: they are much more likely to buy stocks, whereas Europeans hoard their savings in low-return bank deposits.

This willingness to take risks has paid off: in 2008, the market capitalisation of the European Stoxx 600 in USD was roughly equivalent to that of the S&P 500; today the difference is enormous!

The lack of European technology champions and lower spending on research and development could further widen the prosperity gap. Europe must catch up in order to be able to compete globally - both through higher investment and more efficient utilisation of capital.

If Europeans want to preserve their lifestyle, they need to step up their efforts.

As always, we thank you for the trust you have placed in us!

Comments